sales tax reno nv 2019

This is the total of state county and city sales tax rates. The table below shows the county and city rates for every county and the largest cities in.

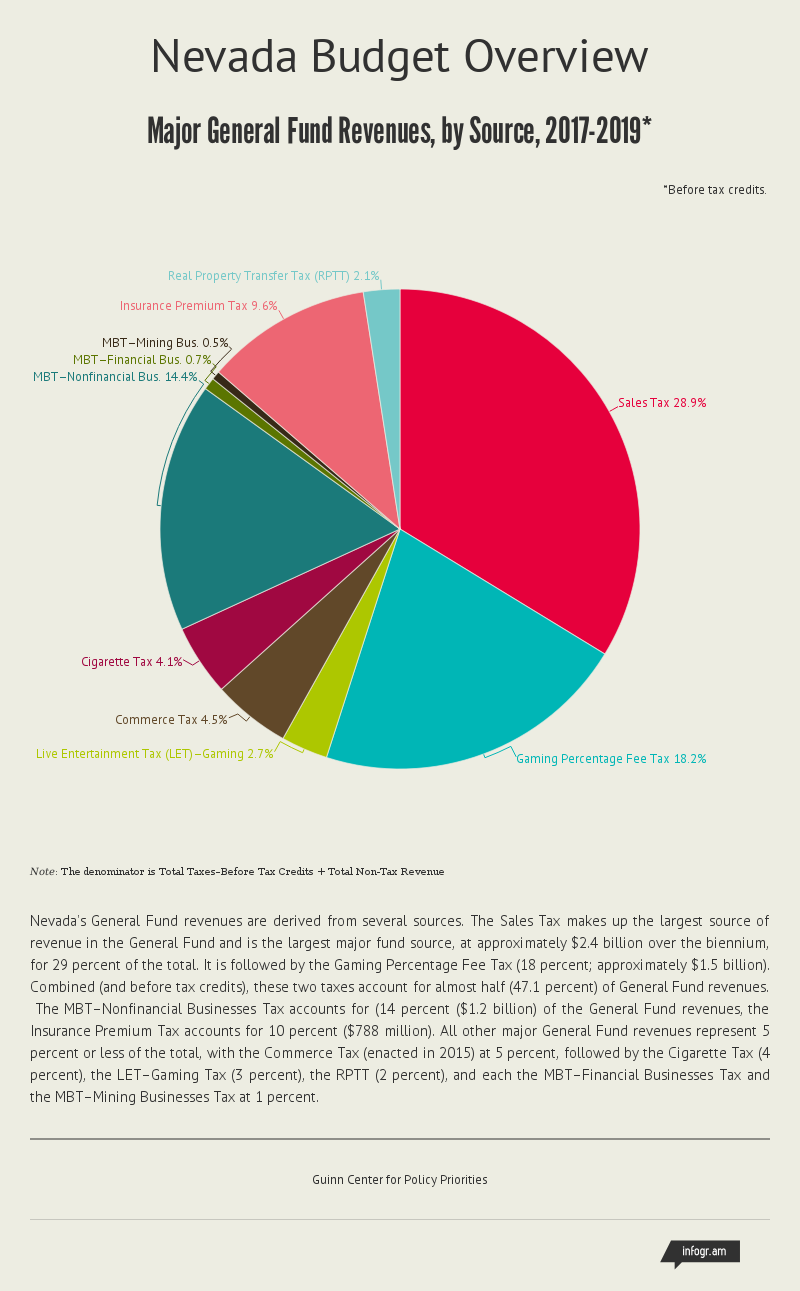

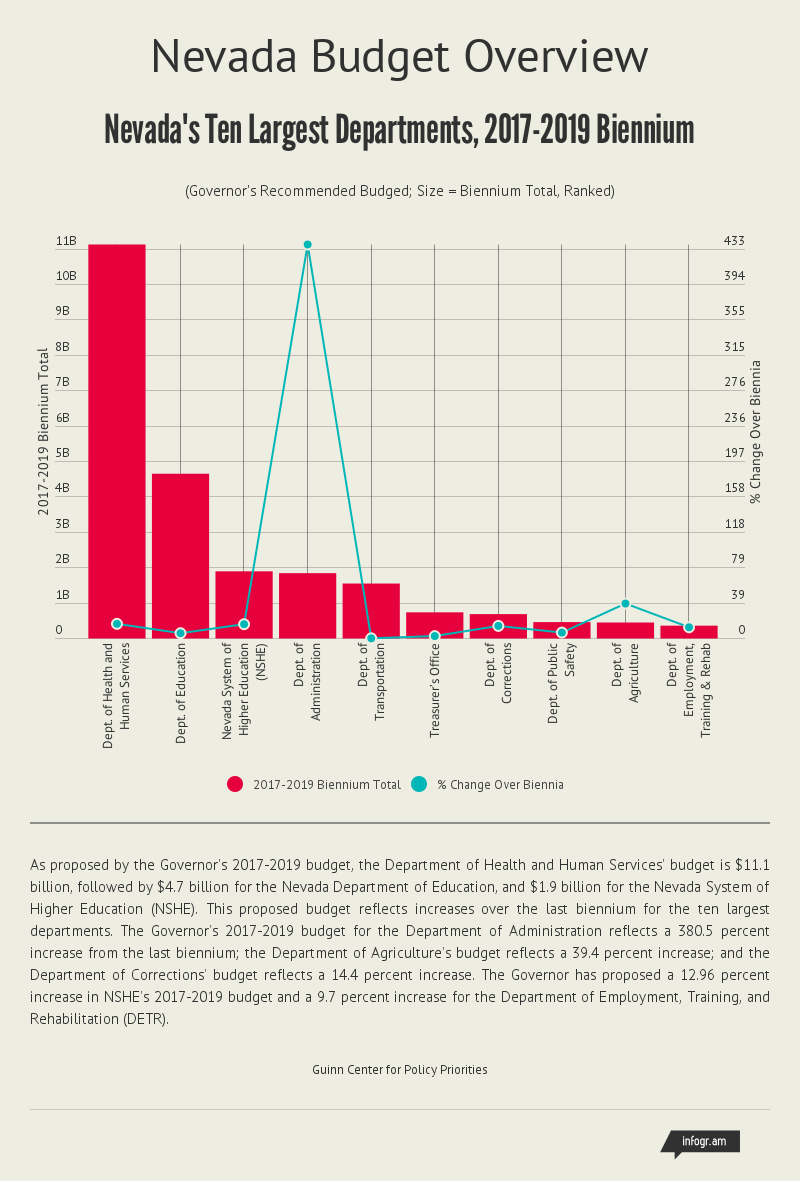

Nevada Budget Overview Guinn Center For Policy Priorities

An alternative sales tax rate of 8265 applies in the tax region Reno which appertains to zip code 89431.

. The current total local sales tax rate in reno nv is 8265. What is the sales tax rate in Reno Texas. College Parkway Suite 115 Carson City NV 89706.

Sales tax rate in Washoe County including Reno and Sparks is 8265 effective April 1. Spring Creek NV Sales Tax Rate. This form effective 712009 reflects the Sales and Use Tax rate changes that occurred for all counties in the 2009 Legislative Session pursuant to SB 429.

Did South Dakota v. Entity description rate authority countyschoolstate. Effective January 1 2020 the Clark County sales and use tax rate will increase to 8375.

If you need access to a database of all Nevada local sales tax rates visit the sales tax data page. Counties are able to impose county option taxes up to 8 cents per gallon. The minimum combined 2022 sales tax rate for Reno Nevada is.

The current total local sales tax rate in reno nv is 8265. Nevada has state sales tax of 46 and allows local governments to collect a local option sales tax of up to 355. The Reno sales tax rate is.

The Reno sales tax rate is. Wayfair Inc affect Nevada. 31 rows The latest sales tax rates for cities in Nevada NV state.

The minimum combined 2022 sales tax rate for Reno Texas is. The Nevada state sales tax rate is 685 and the average NV sales tax after local surtaxes is 794. What is the sales tax rate in Reno Nevada.

89432 89434 89435 89436 and 89441. The current total local sales tax rate in reno nv is 8265. Did South Dakota v.

For tax rates in other cities see Nevada sales taxes by city and county. The december 2020 total local sales tax rate. The Sparks Nevada sales tax rate of 8265 applies to the following five zip codes.

Groceries and prescription drugs are exempt from the Nevada sales tax. Wayfair Inc affect Texas. There is no applicable city tax or special tax.

The sales tax rate does not vary based on zip code. The average cumulative sales tax rate in Reno Nevada is 827. Click any locality for a full breakdown of local property taxes or visit our Nevada sales tax calculator to lookup local rates by zip code.

The 8265 sales tax rate in Reno consists of 46 Nevada state sales tax and 3665 Washoe County sales tax. Rates include state county and city taxes. Counties and cities can charge an additional local sales tax of up to 125 for a maximum possible combined sales tax of 81.

Reno countys 2021 total did best in 2019 but was less than november 2016 which set the countys record for november prior to last year. 1993 statutes of nevada page 1420 chapter 442 ab395 district courts 0192 nrs 30107. Within Reno there are around 23 zip codes with the most populous zip code being 89502.

The Nevada sales tax rate is currently. For every motor truck truck-tractor or bus which has a declared gross weight of. 2020 rates included for use while preparing your income tax deduction.

Of Taxation 1550 E. Welcome to the Nevada Tax Center Jan 01 2020 The Department is now accepting credit card payments in Nevada Tax OLT. The county sales tax.

Nevada has 249 special sales tax jurisdictions with local sales taxes in. Reno debt 0000 nrs266 reno redevelopment 0000 nrs 279426-676. The total overlapping tax rate subject to approval by the Nevada Tax Commission for the City of Reno is 3660615 per 100 of assessed valuation.

Reno NV Sales Tax Rate. There are approximately 62730 people living. The other counties are as follows.

31 rows The state sales tax rate in Nevada is 6850. The Texas sales tax rate is currently. On September 3 2019 the Clark County Commission passed a sales tax increase tied to improving education.

Of Taxation 1550 E. Reno NV 89520-0027 Information. Spanish Springs NV Sales Tax Rate.

This form is to be used as an account document to verify a transaction involving a trade-in or a trade-down for Vessels only and must be completed and filed with your tax return. If you have any questions please contact the. Effective October 1 2019 all marketplace providers are required to collect tax on.

There are a total of 34 local tax jurisdictions across the state collecting an average local tax of 3357. The nevada state sales tax rate is 685 and the average nv sales tax after local surtaxes is 794. This is an increase of 18 of 1 percent on the sale of all tangible personal property that is taxable.

This includes the sales tax rates on the state county city and special levels. Sparks NV Sales Tax Rate. Reno NV 89520-0027 Information.

Nevada Income Tax Rate 2020 - 2021 Oct 11 2018 Nevada state income tax rate for 2020 is 0 because Nevada does not collect a personal income tax. Therefore a home which has a replacement value of 100000 will have an assessed value of 35000 100000 x 35 and the home owner will pay approximately 1281 in property taxes 35000 x 3. Nevada income tax rate and tax brackets shown in the table below are based on income earned between January reno nevada sales tax rate 2019 1 2020 through December 31 2020.

Up to date 2022 Nevada sales tax rates. College Parkway Suite 115 Carson City NV 89706 High reno nevada sales tax rate 2019 desert mountain city and college town University of Nevada Reno of. The County sales tax rate is.

Reno is located within Washoe County Nevada. This is the total of state county and city sales tax rates. Tax rates for 20182019 washoe county nevada.

Effective january 1 2020 the clark county sales and use tax rate increased to 8375. Use our sales tax calculator or download a free Nevada sales tax rate table by zip code. You can print a 8265 sales tax table here.

Reno nevada sales tax rate 2019. Average Sales Tax With Local. The County sales tax rate is.

Sales Tax In Las Vegas Nv Sema Data Co Op

Used Chevrolet Equinox For Sale In Reno Nv Edmunds

All Dodge Dealers In Reno Nv 89502 Autotrader

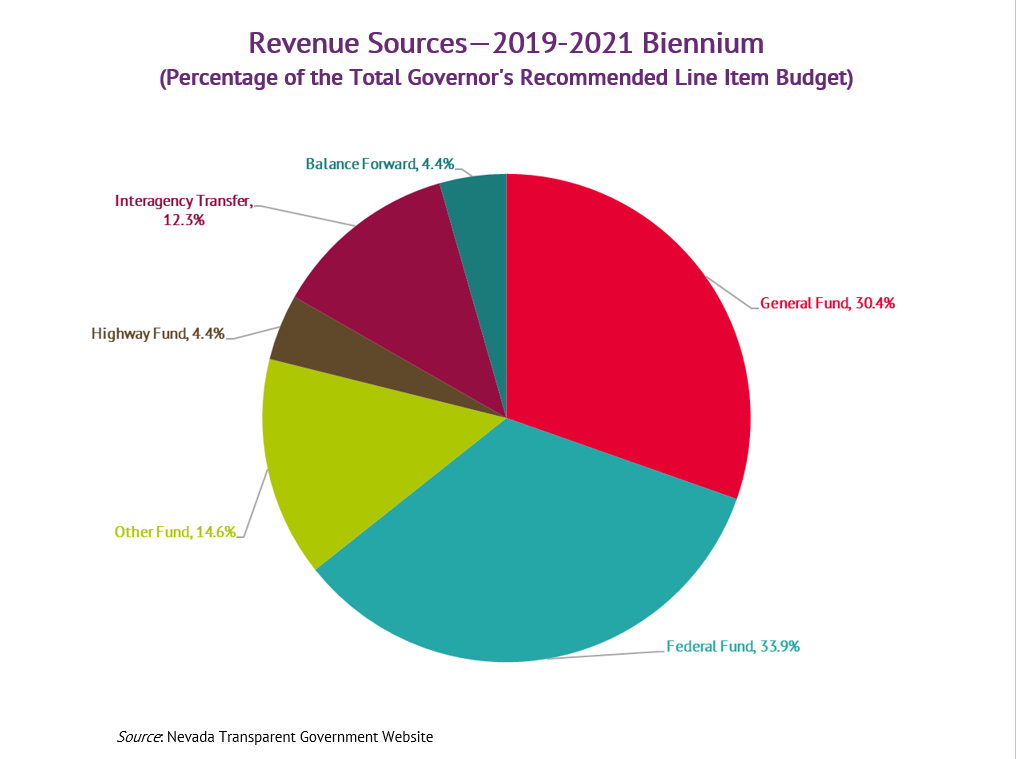

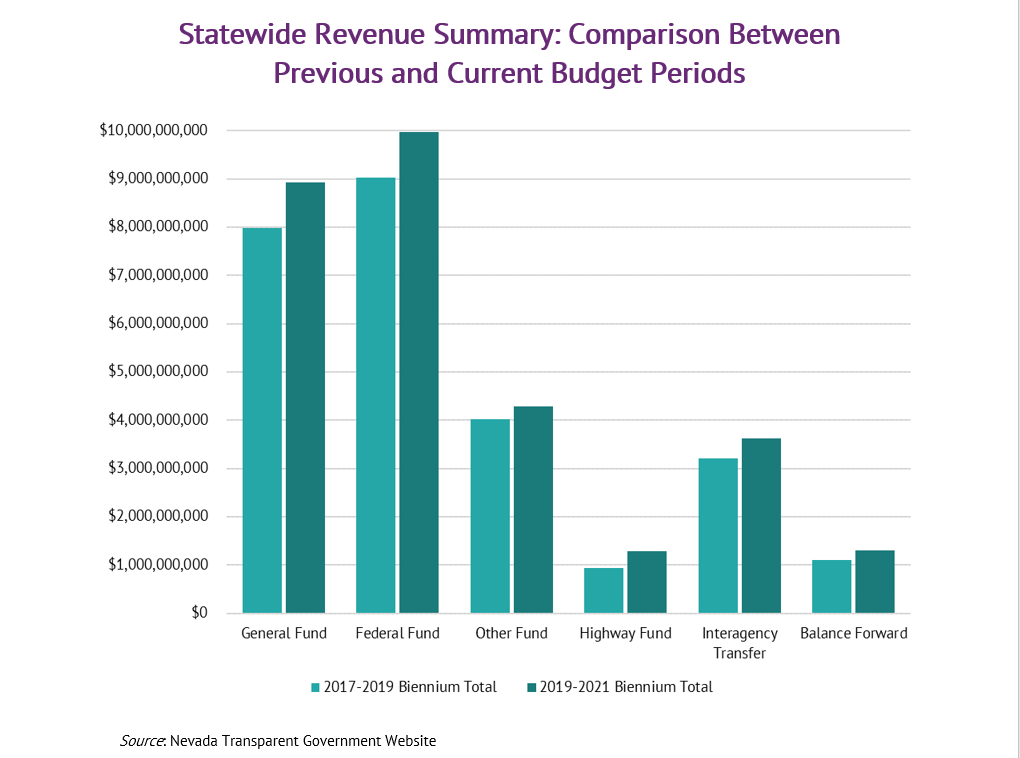

Nevada Budget Overview 2019 2021 Guinn Center For Policy Priorities

Used Chevrolet Traverse For Sale In Reno Nv Edmunds

Nevada Budget Overview Guinn Center For Policy Priorities

Nevada Sales And Use Tax Close Out Form Download Fillable Pdf Templateroller

Nevada Budget Overview 2019 2021 Guinn Center For Policy Priorities

Reno Nevada Nv Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Nevada Budget Overview 2019 2021 Guinn Center For Policy Priorities

Used Gmc Canyon For Sale In Reno Nv Edmunds

Used Gmc Sierra 1500 For Sale In Reno Nv Edmunds

Used Chevrolet Blazer For Sale In Reno Nv Cargurus

Lexus For Sale In Carson City Nv Carson City Hyundai

Used Acura Mdx For Sale In Reno Nv Cargurus